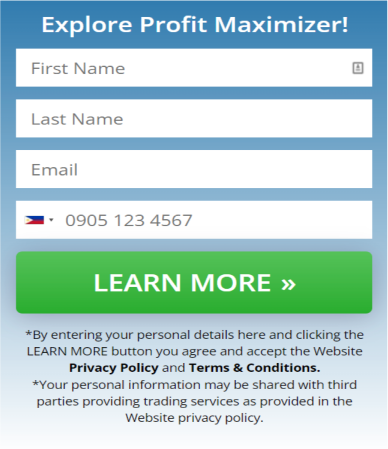

Cryptocurrency exchanges play a crucial role in the crypto ecosystem, serving as a platform for users to buy, sell and trade cryptocurrencies. With the increasing popularity of cryptocurrencies, the demand for crypto exchanges has risen significantly in recent years. As a result, these exchanges are evolving to meet the changing demands of their users. To begin trading bitcoin, click the image below.

Changing Demands of Crypto Exchange Users

The rise of DeFi (Decentralized Finance) has significantly impacted the demands of crypto exchange users. DeFi protocols allow users to borrow, lend, and trade cryptocurrencies without relying on intermediaries. This has led to a surge in demand for decentralized exchanges (DEXs), which are built on top of DeFi protocols. DEXs offer users more control over their funds and are generally considered more secure than centralized exchanges.

Another changing demand of crypto exchange users is increased transparency and security. Crypto exchanges have been plagued by security breaches and hacks, resulting in millions of dollars in losses for users. As a result, users are demanding more transparency and security from exchanges to protect their funds.

How Crypto Exchanges are Adapting to Meet Changing Demands

Crypto exchanges are adapting to meet the changing demands of their users in a variety of ways. One of the ways in which they are doing this is by implementing new security measures. For example, many exchanges are now using multi-factor authentication and biometric verification to ensure that users are who they say they are. Some exchanges are also implementing cold storage solutions, which keep the majority of user funds offline in order to protect them from hacks and other security threats.

Another way in which crypto exchanges are adapting to meet changing demands is by integrating with DeFi protocols. By doing so, exchanges are able to offer users more options for trading and investing in cryptocurrencies. For example, Binance, one of the largest crypto exchanges in the world, has launched its own DeFi platform called Binance Smart Chain. This platform allows users to access a variety of DeFi applications, including decentralized exchanges, lending platforms, and more.

In addition to integrating with DeFi protocols, crypto exchanges are also increasing transparency through public audits. Coinbase, one of the most popular exchanges in the United States, recently announced that it will be conducting regular public audits of its holdings in order to increase transparency and accountability. This move is a response to user demands for greater transparency from exchanges.

Examples of How Crypto Exchanges are Adapting to Changing Demands

Let’s take a closer look at some specific examples of how crypto exchanges are adapting to changing demands:

Binance Smart Chain: As mentioned earlier, Binance has launched its own DeFi platform called Binance Smart Chain. This platform offers users a wide range of DeFi applications, including decentralized exchanges, yield farming platforms, and more. By integrating with DeFi protocols, Binance is able to offer its users more options and greater flexibility when it comes to trading and investing in cryptocurrencies.

Coinbase Public Audits: Coinbase, one of the largest exchanges in the United States, recently announced that it will be conducting regular public audits of its holdings. These audits will be conducted by an external, third-party auditor and will provide users with greater transparency and accountability. This move is a response to user demands for greater transparency and security from exchanges.

Kraken Security Measures: Kraken, one of the oldest and most respected exchanges in the world, is constantly implementing new security measures to protect user funds. For example, Kraken recently implemented a new system for password recovery that is designed to prevent hackers from gaining access to user accounts.

Conclusion

In conclusion, crypto exchanges are adapting to the changing demands of their users by implementing new security measures, integrating with DeFi protocols, and increasing transparency through public audits. The rise of DeFi has significantly impacted the demands of crypto exchange users, leading to a surge in demand for decentralized exchanges. Additionally, users are demanding more transparency and security from exchanges in order to protect their funds. The examples provided, such as Binance Smart Chain, Coinbase Public Audits, and Kraken Security Measures, illustrate how crypto exchanges are evolving to meet these demands. It is clear that the future of crypto exchanges will continue to be shaped by the evolving needs and demands.